Buying a vehicle is one of one of the most exciting landmarks in life, however allow's be sincere-- it can also be a little overwhelming. In between picking the best design, considering new versus secondhand options, and taking care of funding, it's simple to really feel shed in the process. That's why comprehending just how car financing functions is vital to making smart, positive choices when you're all set to hit the road in your next cars and truck or vehicle.

This overview is here to walk you with the ins and outs of auto financing-- breaking down the terms, using real-world understanding, and aiding you prepare to browse your acquisition like a pro.

The Basics of Vehicle Financing: What You Need to Know

Funding a vehicle essentially indicates obtaining money from a loan provider to buy a lorry. As opposed to paying the complete rate upfront, you make month-to-month settlements with time. These settlements consist of both the principal (the cost of the cars and truck) and passion (the expense of borrowing).

Lenders usually examine your credit history, earnings, employment status, and existing financial debt to identify your eligibility and interest rate. The far better your credit report and monetary health, the more desirable your financing terms are most likely to be.

It might seem like a basic process-- and in several methods, it is-- but there are a lot of choices to make along the road that can affect your long-term prices.

New vs. Used: Making the Right Choice for Your Budget

One of the initial big choices you'll face is whether to fund a new or secondhand vehicle. New cars use that alluring showroom shine and the most up to date tech, yet utilized lorries can supply significant savings and usually hold their value much better over time.

Lots of drivers lean toward used car dealership alternatives to stretch their spending plan while still landing a trustworthy car. With licensed used programs and detailed automobile background reports readily available, purchasing made use of has ended up being a far more protected and eye-catching route.

Your financing terms might vary between new and previously owned cars too. Lenders typically supply lower rate of interest for new autos, but since the cost is greater, your month-to-month payments may be as well. Made use of cars may come with somewhat higher rates, however the lower financing quantity can aid maintain settlements manageable.

How Loan Terms Affect Your Monthly Payment

When financing a vehicle, you'll select the length of your funding-- frequently varying from 36 to 72 months. A longer lending term implies lower monthly settlements, yet it additionally indicates you'll pay a lot more in rate of interest gradually.

Shorter car loan terms come with higher month-to-month repayments however lower total rate of interest costs. Finding the appropriate equilibrium depends on your financial objectives and the length of time you plan to maintain the automobile.

If you're planning to sell for a newer model in a couple of years, a shorter term could match you finest. If you're aiming for one of the most budget-friendly month-to-month repayment, a longer term might be a lot more comfortable; simply keep in mind the lasting cost.

Deposits and Trade-Ins: Lowering Your Loan Amount

A smart means to decrease your loan quantity-- and therefore your regular monthly payments-- is by making a solid deposit or trading in your current automobile.

Taking down 10% to 20% of the automobile's rate can considerably improve your finance terms. Plus, a strong deposit reveals lenders you're economically accountable, which can aid you lock in a reduced rates of interest.

If you're trading in your present auto, that value goes directly toward your new automobile acquisition. Many individuals visit a used car dealership to evaluate the trade-in worth of their existing adventure, helping them budget more accurately for their next purchase.

Comprehending APR: What You're Really Paying

The Annual Percentage Rate (APR) is the overall expense of obtaining cash-- consisting of both the rate of interest and any type of lending institution costs. It's real profits when comparing financing offers, and it's the number you ought to pay the closest attention to.

A low APR can conserve you thousands over the life of a car loan. It's worth shopping around and obtaining pre-approved prior to you head to the truck dealership, so you know precisely what you're dealing with and can contrast deals with confidence.

Your credit score is a big element right here. If you're not quite where you wish to be, take a few months to enhance your credit by paying down debt and making consistent payments-- it can make a big difference.

Leasing vs. Financing: Which is Better for You?

While this overview concentrates on funding, it's worth noting that leasing is another choice that could suit some buyers. Leasing typically includes lower month-to-month settlements and enables you to drive a new car every couple of years.

Nevertheless, you don't own the car at the end of the lease, and there are typically mileage restrictions and wear-and-tear fines. Financing, on the other hand, builds equity-- you possess the automobile outright once the lending is paid off.

For vehicle drivers who plan to maintain their car for the long run or put a great deal of miles on it, financing through a reputable truck dealership is generally the more monetarily sound alternative.

What to Bring When You're Ready to Finance

Being prepared can accelerate the funding process and aid ensure you obtain the best feasible terms. When you head to the dealership, bring:

Your motorist's license

Proof of insurance policy

Recent pay stubs or proof of revenue

Proof of home

Credit report or pre-approval (if offered)

Trade-in documentation (if applicable)

Having every one of this all set makes it simpler to review different financing choices right away and move forward with confidence.

Checking Out Options for Chevrolet Fans

If you've obtained your eye on Chevrolet trucks up for sale, you're not the only one. These automobiles are known for their resilience, performance, and value-- making them an excellent suitable for both day-to-day drivers and major adventurers alike.

Whether you're searching for a durable workhorse or an elegant, road-ready SUV, funding alternatives can aid make your ideal Chevrolet more attainable. The right truck dealership will walk you through the procedure, clarify every information, and see to it you're obtaining the offer that finest fits your life.

Financing Tips for First-Time Buyers

If this is your first time funding a lorry, below are a few quick tips to remember:

Know your credit report prior to you shop.

Set a strong budget plan and stay with it.

Factor in tax obligations, charges, and insurance prices.

Do not be afraid to ask questions-- your convenience matters

Think about getting pre-approved for funding before seeing a used car dealership

The very first car you fund sets the tone for your future credit history opportunities, so take your time, remain informed, and be deliberate about every step.

Keep Connected and Informed

Automobile financing doesn't read this need to be complicated-- and when you're educated, it can actually be encouraging. Whether you're eyeing Chevrolet trucks for sale, checking out funding for the first time, or seeing a truck dealership to weigh your choices, the procedure can be exciting and satisfying.

Keep tuned for more blog updates to maintain learning and making the smartest cars and truck choices possible. We're right here to aid guide your journey-- so do not be an unfamiliar person. Come back soon and drive ahead with self-confidence.

Gia Lopez Then & Now!

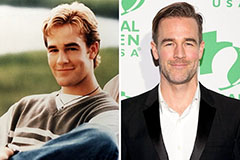

Gia Lopez Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Mason Reese Then & Now!

Mason Reese Then & Now! Tina Majorino Then & Now!

Tina Majorino Then & Now! Morgan Fairchild Then & Now!

Morgan Fairchild Then & Now!